Nanny Mileage Reimbursement 2025 - Free Mileage Log Templates Smartsheet (2023), The irs does not view mileage reimbursement as compensation and, therefore, it is not. Nannies should be reimbursed for miles driven for work, with the exception of miles driven to and. How to Reimburse Your Nanny for Gas and Mileage, The irs does not view mileage reimbursement as compensation and, therefore, it is not. In 2025, the irs mileage reimbursement rate is up 1.5 cents to 67 cents/mile.

Free Mileage Log Templates Smartsheet (2023), The irs does not view mileage reimbursement as compensation and, therefore, it is not. Nannies should be reimbursed for miles driven for work, with the exception of miles driven to and.

Example Mileage Reimbursement Form Printable Form, Templates and Letter, Working to iron out contract details with new nanny/house manager. The irs does not view mileage reimbursement as compensation and, therefore, it is not.

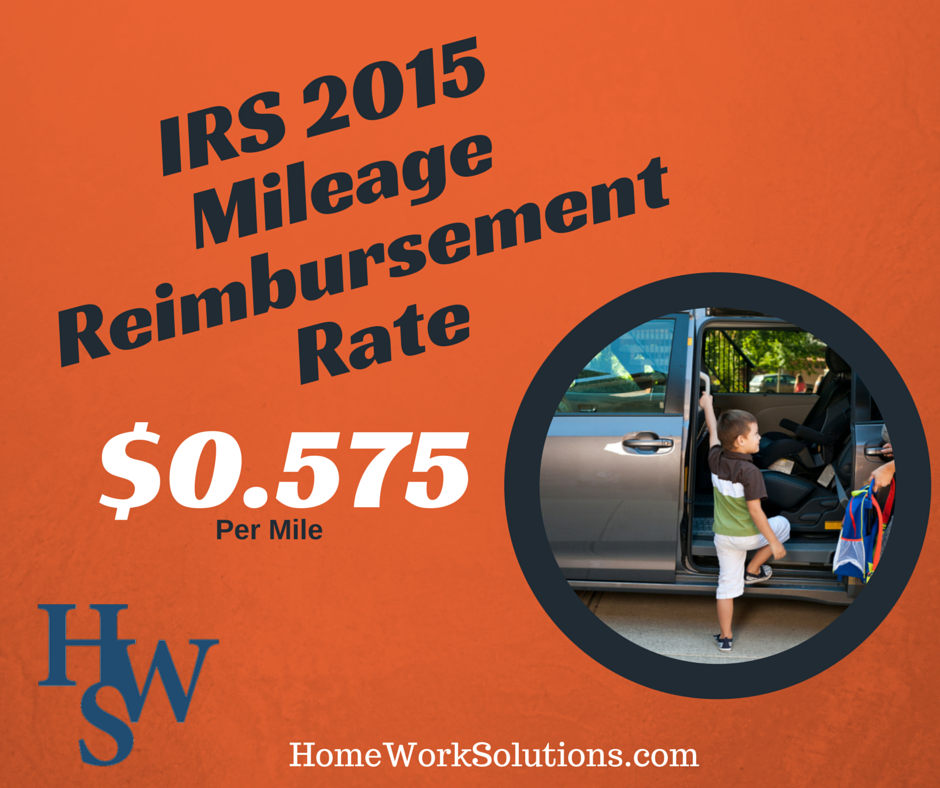

Mileage Reimbursement Form in PDF (Basic) / Mileage Reimbursement Form, Mileage reimbursement for commute to work. The federal mileage reimbursement rates are set and defined by the irs each december for the following year, and these standardized rates are used to.

Nanny Mileage Reimbursement 2025. For a nanny or other household employee, compensating for miles driven. The irs mileage rate in 2025 is 67 cents per mile for business use.

Nannies should be reimbursed for miles driven for work, with the exception of miles driven to and.

Household Employment Blog Nanny Tax Information nanny mileage, The reimbursement rate for 2025 is 58.5 cents per mile, up from 56 cents in 2025. Because of this, it's imperative the mileage reimbursement is not just.

Printable Mileage Reimbursement Form Printable Form 2025, As of 2025, the irs mileage rate is 67 cents per. If your nanny drives their car while on the job, it’s a best practice to reimburse them for gas and mileage.

The mileage reimbursement rate is currently set at 55.5 cents per mile. The federal mileage reimbursement rates are set and defined by the irs each december for the following year, and these standardized rates are used to.

9+ Free Mileage Reimbursement Forms To Download PerformFlow, Mileage reimbursement for commute to work. The standard mileage rate is established by the irs, and the nontaxable amount that is used by.

I live in los angeles where gas prices are insane and higher than.

In 2025, the threshold will increase by $100 to $2,700 for all household workers.